Expense management software

Expense management software for stress-free business spending and reimbursement With ExpenseOut.

you can focus on growing your business because the next-gen expense management software takes care of reporting, approving, and reimbursing business expenses made by employees without any hassle to you.

you can focus on growing your business because the next-gen expense management software takes care of reporting, approving, and reimbursing business expenses made by employees without any hassle to you.

Expense Management Software Customers across the world love the Artificial Intelligence capabilities of ExpenseOut

ExpenseOut is extremely user-friendly and lets me keep track of the expenses of my on-field team in a seamless and non-intrusive manner. The software has been a lifesaver.

ExpenseOut user

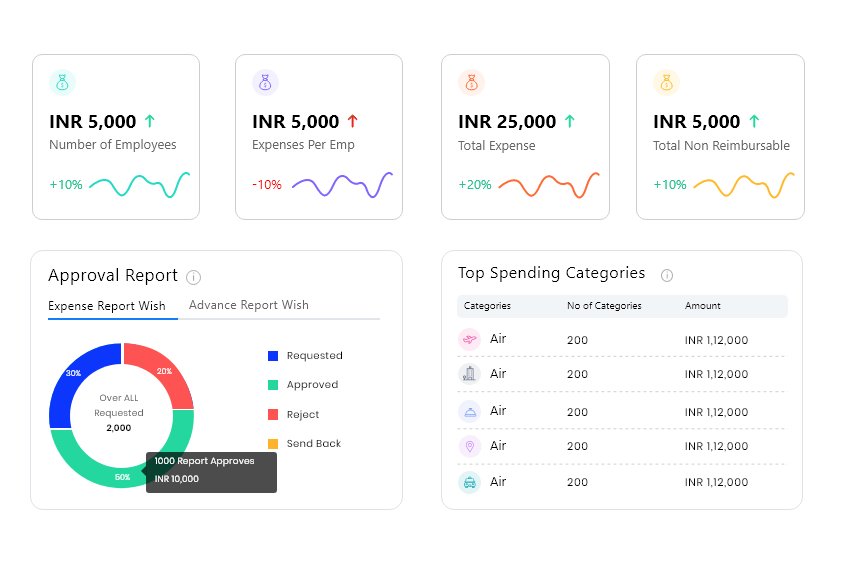

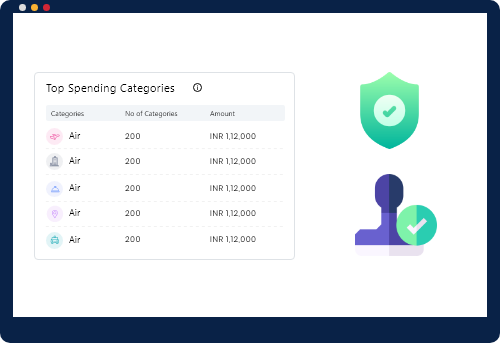

What I love the most about ExpenseOut is that as an admin, I can conveniently get insights on my employees’ spending on a user-friendly dashboard.

ExpenseOut customer

Start your 14-days free trial

After The Trial, You’ll Be Downgraded To A Basic Plan

Expense Reporting And Tracking With OCR

Employees can leverage the OCR technology to scan key details automatically from their receipts and store them securely so that you can retrieve them at your convenience, unlike crumbling paper receipts. Due to this, employees can accurately and quickly report expenses that can be tracked in real-time.

Automated Expense Approvals

Employees can make sure that their receipts, stored in a digital vault, are submitted at the end of the present period. The admin (the management or the finance team) can quickly go through the information category/department/ employee-wise and either approve or reject the entry based on company policy.

Lightning-Fast Reimbursements

Reimbursement, a normally long and tedious process, can be automated entirely with ExpenseOut. The system checks every expense report’s authenticity and approves/ rejects it based on corporate policy. The admin can also allow the employee to submit a non-compliant report with an explanation.

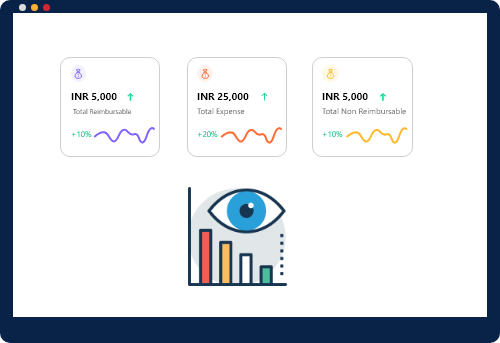

Extensive Analytics

In real-time, you will be able to get actionable insights on your employee spending, which can be used to formulate budgets or even new spending policies to optimize revenue. Due to the comprehensive analytics that ExpenseOut provides, no one can get away with fraud/ duplication/ /overspending.

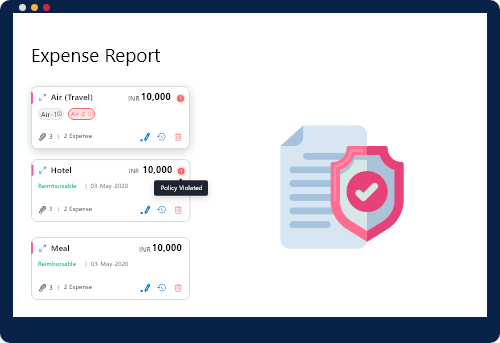

100% Policy Compliance

Using ExpenseOut, an organization can gauge the level of risk in every transaction an employee is making. Since each transaction is checked against preset company policy for travel and expenses, the system ensures policy compliance and brings discrepancies to the attention of the adman.

Get the expense management software everyone loves

Benefits of the upgraded ExpenseOut expense management software

There is no shortage of benefits that ExpenseOut will provide for all stakeholders when managing your company’s travel and expenses. With ExpenseOut, you are guaranteed the following benefits that will make expense tracking and reporting a delightful experience.

Expense management software For employees

- It is a non-intrusive tool for on-field employees to make the management aware of productivity, mileage, etc.

- Further, it is an easy-to-use expense tracker that allows them to click photos of their receipts and store them away on the cloud for later use.

- Automated expense report generation is another highlight that will save countless hours that can be used productively.

- Aside from that, there will be no more need for storing old receipts and filling out lengthy expense reports.

- Instant reimbursement for expenses, another essential benefit, will lead to happier employees.

Expense management software For manager

- It saves countless hours from not having to approve each expense report manually.

- Further, the manager can provide cash loans for select employees based on the appropriate criteria, which can be easily modified.

- Real-time notifications will arrive every time company money is spent, meaning the manager can handle discrepancies instantaneously.

- It is further worth noting that the manager can closely monitor the overspending of funds.

- ExpenseOut provides real-time, actionable reports that the manager can leverage to create budgets and update company policy on spending.

- The manager can also monitor on-field employee mileage use and productivity in real-time.

Expense management software For the finance team

- Automatic claim settlement means that the finance team will not have to go through countless old receipts.

- Policy compliance features ensure that the finance team no longer has to spend hours checking each transaction manually.

- Clear reports of company spending from the expense management software means the finance team can finish balancing books in no time.

- Increased flexibility to provide access to funds based on designation and deny non-compliant requests, such as holiday expenses will go a long way in ensuring policy compliance.

ExpenseOut provides you with automated expense management software for all your business needs

24X7 Support

Call and email assistance

Onboarding assistance

Get Better Spending Visibility By

- Automatically reviewing expenses for fraud and other malpractice

- Having customized dashboards for the management and finance team

- Setting up rules beforehand to weed out shady vendors

- Having a budget and crosschecking it with the expenses

Make Every Expense Report Policy-Compliant By

- Making sure of compliance from the time each receipt is entered

- Monitoring the live location of employees

- Automatically removing non-compliant expenses, such as holiday expenses

- Setting up a strict compliance framework as per employee designation

Provide Better Employee Experience By

- Letting employees easily track all their spending in one place

- Providing employees with per diem for trips

- Automatically warning employees of non-compliant entries

- Instantly and automatically reimbursing them for company expenses

Ensure Pain-Free Spending And Approval By

- Getting a 360-degree view of all spending in each category

- Having access to department-wise/ individual spending records

- Having a lively dashboard containing policy violations and compliant spends

- Setting limits on what each employee is allowed to spend

Bring Down Business Expenditure By

- Eliminating the cost of manually preparing expense reports

- Cutting down on fraud in employee-prepared expense reports

- Spotting and preventing overspending in seconds

- Enhancing the productivity of the people approving the expenses

Go Digital In Your Expense Tracking Efforts By

- Allowing employees to report expenses just by taking a picture of the receipt

- Automatically reimbursing employees without having to submit old receipts

- Integrate with your preferred software to perform end-to-end expense tracking

- Avoiding the tedious manual process of checking old receipts for policy compliance

Advanced expense Management Software at affordable prices

Free

-

Included in Free

-

6 gb receipt storage

-

Multicurrency expenses

-

Mileage expenses

-

Single layer approval

-

Single layer settlement

Premium

-

Everything in Free +

-

Cash advances

-

Advances approval

-

Multilevel expense approval

-

Receipt auto-scan (OCR)

-

Per diem automation

-

Policy configuration

-

Customer / Project tracking

Enterprise

-

Everything in Premium+

-

Advanced auditing report

-

500 minimum user count

-

TMC / OTA integration

-

ERP integration

-

Single sign on

-

Dedicated account manager

FAQ

Yes, ExpenseOut allows the management/ finance team to set spending limits based on the designation. For instance, you can prevent a new employee from flying first class on a flight.

Yes, you absolutely can! Sign in to try ExpenseOut for free until you scale up operations and need a paid version. Our team is always accessible to provide you with a demo before you start.

Yes, ExpenseOut is capable of that. Once you have set the policies, the expense management software will ensure that employees cannot submit any expense for approval if it does not meet your criteria. If you want, you can also allow the employee to submit the expense with an explanation for the violation. You can approve or reject the entry based on whether the reason is valid.

ExpenseOut uses AI to monitor policy compliance by your employees and allows you to approve expenses meeting the preset criteria automatically. Consequently, it saves you a lot of the time and money that goes into manually tracking, approving, and processing expenses.

Next-gen expense management software for end-to-end automation of employee spend tracking

What is expense management software?

Expense management software is an application that either automates or simplifies most of the process of managing travel and expenses (T&E) of organizations that rely on business travel. Usually, the process from receipts to reimbursement is filled with a lot of paper, countless hours, wasted resources, potential fraud, and overall chaos in the company.

However, the introduction of an expense management software can drastically improve things, given that it helps manage travel bookings, digitizes the receipt submission process, streamlines multi-level approvals, fast-tracks reimbursements, and helps track expenses in real-time.

Besides, expense management software can ensure that every employee expense is in alignment with corporate travel policy.

Why cloud-based expense management software is a necessity

Switching to cloud-based expense management software has a plethora of benefits compared to legacy expense management solutions.

Effective receipt management

- With the help of a feature-rich expense management software, employees can scan their receipts by means of OCR functionality that can pull out key information, such as the category of spend, merchant name, amount, and date.

- The receipts will be stored in a digital vault on the cloud, and they can be accessed whenever needed.

- Owing to this facility, employees don’t have to carry old, crummy receipts, and the finance team doesn’t have to sift through countless hard-to-read receipts and struggle to verify their authenticity.

- Besides, this feature of cloud-based expense management software is incredibly useful for auditing purposes, when accountants can trace receipts back to their source without difficulty.

Seamless enforcement of corporate T&E policies

- Finance teams around the world are faced with the constant struggle of having to enforce corporate travel policy and also detect expense fraud.

- Using the right expense management software, finance teams can automate the enforcement of all their corporate policy based on employee designation and even set up checks to prevent overspending.

- Interestingly, companies can further decide the consequence of policy violations.

Quicker expense reimbursements

- One of the primary benefits of an expense management solution is that it speeds up the process of the submission of expense reports, processing, and approval by all levels.

- Consequently, employees can get timely reimbursements on the same day they submit a request, as opposed to the week-long process they had to undergo earlier.

How you can pick the right expense management software

Ideally, you need an expense management solution that is highly scalable, fits your company requirements, and is feature-rich as well. Here’s a quick checklist to help you get started with the right expense management software.

- Powerful integrations, especially with accounting software

- Automated expense policy compliance checking

- Multi-level approval capabilities

- OCR functionality to scan receipts

- Mobile accessibility

- Online reimbursements and expense reporting

- Real-time spend analytics

Why ExpenseOut expense management software will be beneficial for you

Our industry-leading expense management software will be of massive benefit to your organization due to its following capabilities:

- Track employee expenses in real-time

- Let employees easily report expenses by capturing receipts on their smartphone cameras

- Enforce spending policies based on designation/department

- Make faster reimbursements

- Effortlessly provide multi-level approval for expenses

- Get comprehensive insights on spending across departments or individuals to make better business decisions

- Cut down errors in filing expenses

- Become audit-ready in a pain-free manner

- Save countless hours for your finance team, employees, and the management